Automotive and Electronics Industries Convene to Prioritize Challenges

By Tracy Riggan, IPC Senior Director, Solutions

Representatives from global companies across the value chain were invited by AIAG, IPC, and SEMI to discuss and consider industry challenges by their importance as well as the feasibility of solutions. When asked to list the automotive electronics challenges most ripe for industry cooperation and association support, automotive and electronics industry leaders prioritized quality and reliability, supply chain resiliency and transparency, and electrification. Sixteen industry leaders, primarily from technical/engineering functions but including quality, strategy, and purchasing/marketing professionals from vehicle OEMs, automotive Tier 1s, semiconductor part and processing equipment suppliers, and electronic component/device part and processing technology suppliers came together for the virtual focus group which took place September 1, 2021.

10 Top Priority Challenges

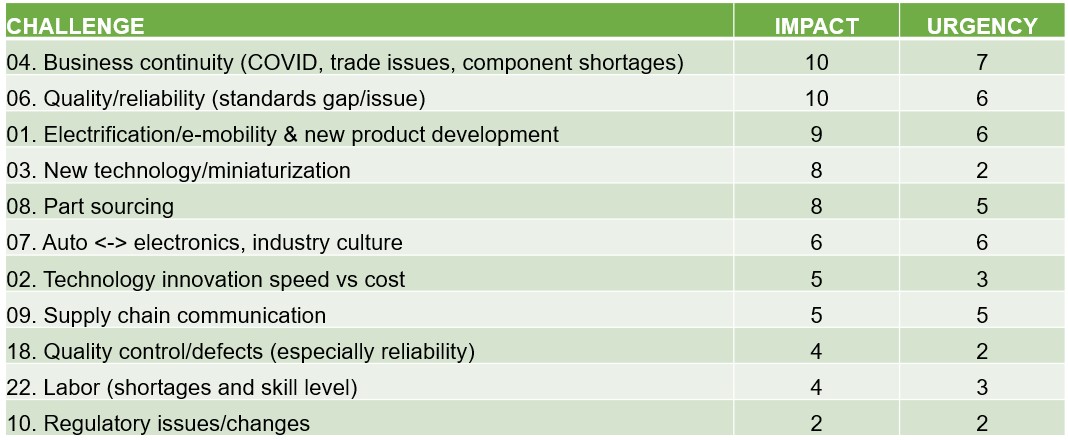

In late 2020, AIAG, IPC, and SEMI issued an industry survey documenting the industry’s views on the top challenges and opportunities for automotive electronics as well as views on how they look to associations to help. The survey yielded 22 challenge areas, 10 of which were narrowed by the associations to a proposed 10 ‘top priority challenges.’ The focus group discussed these top priority challenges in depth, including updating the list to pull reliability through defect measurement and labor/skill shortages into the top 10 before ranking the challenge areas individually by impact and urgency.

One respondent to the survey aptly summarized the gamut of challenges that made up the ultimate list, “Poor customer designs, unclear customer requirements, customers who don't like being asked to clarify requirements, component availability, AIAG standards/books that don't work for complex electronics” and suggesting that associations can work to bring “better clarity in industry standards [and the assurance that] industry standards cover more possible nonconforming conditions (Tier 2, Device Manufacturer)

Feasibility of Solutions

Following these results, the Top Priority Challenges were considered in terms of feasibility or the degree of effort toward and likelihood of success of solutions, including the ability for associations to drive necessary action to address the challenges. This group further honed the list to 5 topics judged to be the most feasible to solve. In the interest of time, the group discussed their top 3.

- Supply Chain Resiliency

- Quality/Reliability – Zero Defects

- Electrification

Supply Chain Resiliency & Transparency

One focus group participant cautioned, “We need to look at growth and capacity vs. shortages. If we don’t get this right, we might even end up with oversupply down the road.” (VP of Marketing, Semiconductor Company) The many recent ‘unexpected’ events play a part in this rising to the top, including COVID, however lead times going into the pandemic were already long and inventory management was not utilizing a system to withstand significant shifts. The main aspects discussed were the lack of transparency on what inventory is truly available and from whom and the holding of supply as a hindrance to forecasting and measuring risk. The group expressed desire for a simpler supply chain or at least to understand it better. It was agreed that co-development of industry solutions and cooperation will assure the best result. Suggested potential solutions included a way to fast-track approval of new solutions from new sources, inventorying production capabilities, and education related to the accuracy and benefits of software platforms which aggregate inventory across suppliers.

Industry Expectations

Quality and Reliability

Quality and reliability rose to the top 10 challenges in several forms, but the group felt the most important was the ambiguity surrounding Zero Defects. A broad range of definitions exist of what zero defects means. Shifting the focus from inspection to prevention is key. Open discussion is happening about what reliability automotive solutions need and what is realistic. With this in mind, a clearer definition of the concept in the frame of current reliability expectations as well as direction on the place, time, and method to measure and assess Zero Defects would benefit industry, according to the group. Additionally, it was questioned if today’s level of factory automation and data analytics are up to the task to make measurement feasible and create the tracing required. A clear connection between the front and backend of the supply chain to enable communication necessary for such traceability was mentioned in multiple contexts.

Electrification

Electrification was highlighted as a more urgent need while advanced node technologies was noted as an ongoing need which we continue to develop long term. There are many sides to addressing electrification challenges; parts are high-value and often produced outside U.S., design takes time and is highly complex, testing is insufficient, new technology reliability is unable to be fully assessed for the automotive environment, manufacturing increasingly involves handling of dangerous components, and media attention for negative incidents which are not relative, and uninformed suppliers new to automotive. To begin to address these, the group would like to see avenues for suppliers to get more complete information to develop solutions and efforts to localize supply of crucial parts and materials.

Next Steps

The next steps for AIAG, IPC and SEMI will be to draft solution options on the prioritized issues and discuss these in narrowly focused groups to confirm pathways forward and build on plans. AIAG, IPC, and SEMI recognize the criticality and power of cooperation to drive solutions for our industries in this time of rapid development and under new reliability demands.

To learn more about future opportunities to participate in focus groups specific to automotive electronics’ needs, please reach out to

AIAG – contact Dave Mimms, dmimms@aiag.org

IPC – contact Tracy Riggan, TracyRiggan@ipc.org

SEMI – contact Bettina Weiss, bweiss@semi.org